Surviving Spouse, Minor Child of Deceased Parent, Elderly Exemption 17D

Learn more about 17D personal exemptions for a surviving spouse, minor child of a deceased parent, or the elderly.

Those who qualify for a 17D exemption will receive $420 in tax relief in Fiscal Year 2026. The City may grant up to an additional $420 in tax relief. The additional tax relief will NOT be granted if it will:

- make your final 2026 tax bill lower than your final 2025 tax bill, or

- reduce the taxable value of your property below 10 percent of the assessed value.

Eligibility

You may be eligible for this exemption if, as of July 1, one of these personal situations is true:

- your husband or wife is deceased

- your parent is deceased and you are a child under the age of 18, or

- you are 70 years old or older.

You must also meet the following requirements:

- You are a surviving spouse or a minor who has occupied the property as your domicile. Or you are a person age 70 or older who has owned and occupied your property as your domicile for five years or more.

- Any ownership interest must be worth at least $2,000 (contact the Taxpayer Referral and Assistance Center for more information on the ownership requirement).

- The whole estate, not including the value of the property, can't be more than $40,000. For properties that have more than four units or a commercial unit, we include a portion of the value of those units in our whole estate calculation.

Apply for a Personal Exemption

Applications must be filed by April 1 of the current fiscal year.

If you have questions about the requirements for applying for an exemption, or want to know the status of your application, you can call the Taxpayer Referral and Assistance Center at 617-635-4287.

Please note: A Fiscal Year takes place from July 1 through June 30 of the following year. For example, Fiscal Year 2026 (FY26) would be July 1, 2025, through June 30, 2026.

Complete your application

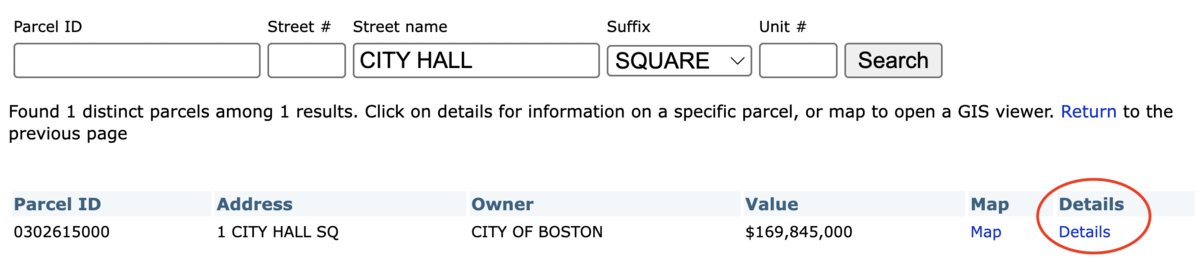

Applications can be downloaded after we issue third-quarter tax bills in December. To download an application, search for and find your property using the Assessing Online tool, then click the "Details" link:

The link to the application will be under the "Abatements/Exemptions" section. For more information on what's possible with Assessing Online, visit our explainer page.

You can also get an application by calling the Taxpayer Referral and Assistance Center at 617-635-4287. Applications can also be completed at City Hall. Remember to bring any additional documents you need for your exemption application.

Submit your application

Bring or mail your completed application and supporting documents to the Assessing Department at City Hall:

ASSESSING DEPARTMENT, ROOM 3011 CITY HALL SQUARE

BOSTON, MA 02201

Exemption Frequently Asked Questions

Frequently Asked QuestionsThrough an exemption, the City releases you from paying part or all of your property taxes.

We will send you a renewal application, but it's still your responsibility to make sure that you file a renewal each year.

The Taxpayer Referral and Assistance Center (TRAC) has three months from the date on which the application was filed to determine the merits of the application.

Approved exemption applicants can expect to see the personal exemption applied to their third-quarter tax bill that will be issued in late December.

If an exemption is denied you will receive a notice of denial in the mail.

If the application is denied, you may file an appeal with the Commonwealth of Massachusetts Appellate Tax Board (ATB) within three months of the date that the denial decision is made. The ATB is located at:

100 Cambridge Street2nd floor, Suite 200

Boston, MA 02114

The ATB can be reached by phone at 617-727-3100.